Latest Insights

What is REIT and INVIT ?

REITs and INVITs are investment vehicles that pool money from investors & invest in infrastructure assets (INVIT) & real estate assets (REIT), directly or through a special-purpose vehicle (SPV).

#INVIT - Where Low Risk Meets High Dividends..

Not much discussed, but investment in this sector is picking up.

Dividend yield of 10-12% ?

Find out below the best INVIT for you..

What is REIT and INVIT ?

REITs and INVITs are investment vehicles that pool money from investors & invest in infrastructure assets (INVIT) & real estate assets (REIT), directly or through a special-purpose vehicle (SPV).

It is new and innovative financial instrument in the Indian context, introduced to boost investments in the country's infrastructure sector.

REIT - Majorly invests in properties like office buildings, shopping malls, hotels, residential apartments and warehouses.

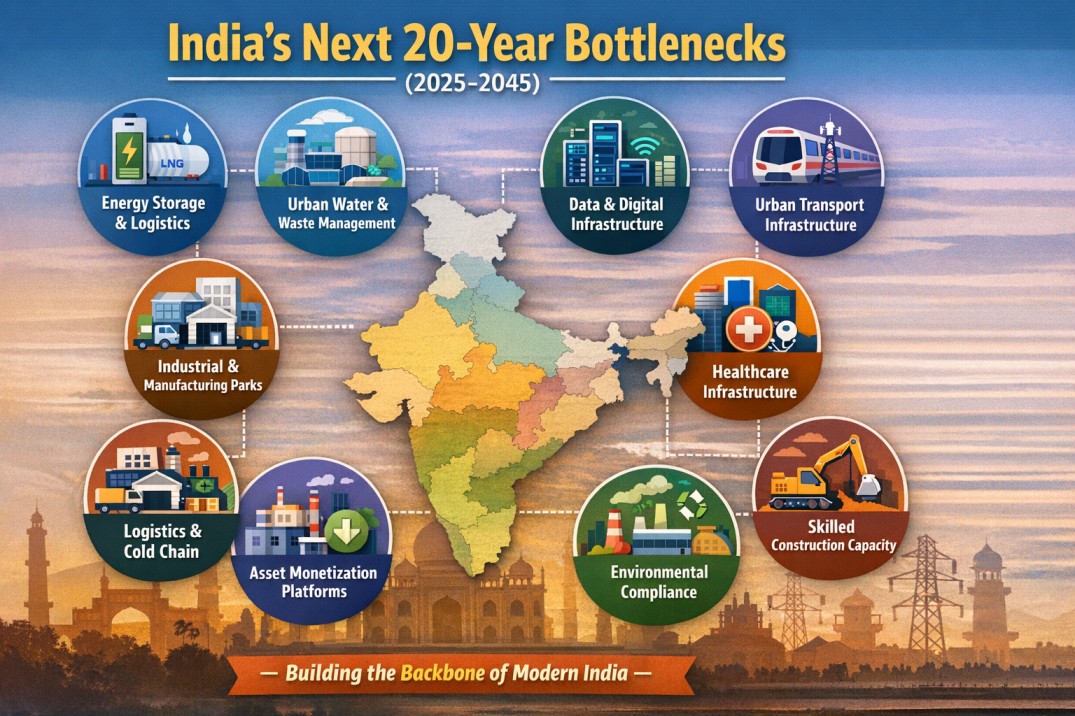

INVIT - Majorly invests in infrastructure project like roads, highways, power plants, airports, & telecommunication towers.

Both work like mutual funds as they pool money from multiple investors & these assets are managed by professional fund managers.

Distributes at least 90% of net distributable cash flows (NDCF) to unit holder.

How we can buy ?

There are 3 listed INVIT in market as of now which retail can buy.

These are listed in Indian market and can be bought like you buy shares.

1.Power grid Infrastructure Investment Trust

2.India Grid Trust (Indi Grid)

3.IRB InvIT Fund

How do investors make money ?

Dividend per unit (DPU)- REIT or INVIT, primarily distribute income from rentals, tolls & property/infrastructure assets as dividend

Price Appreciation: NAV of the units go up when the underlying property / infrastructure appreciates in value.

Advantages ?

Portfolio diversification helps to reduce the volatility of change in portfolio value over a period of time.

Publicly traded InvIT’s offer investor the ability to add infrastructure investment return to their portfolio without incurring the liquidity risk.

The INVIT are meant for investors looking for regular income since they make regular distribution.

Risks ?

It suffers in a rising interest rate market (last 1.5 years)

️Competent Management is key to the success of the INVIT/ REIT & increasing unitholders' returns

Conclusion ?

IndiGrid had a proven track record of execution in last 6.5 years and delivered CAGR return of ~12%.

Dividend yield is 10.15% and CMP is almost equivalent to NAV.

India Grid INVIT is better positioned to provide stable dividend and capture future growth.

India Grid > PowerGrid > IRB INVIT

IndiGrid specifically in renewable sector

IndiGrid owns: Transmission lines,Grid assets,Utility-scale storage

It earns money because:

Power MUST flow and Grid MUST be balanced

Even if:

Solar price falls

Wind output fluctuates

Battery tech improves

The grid still needs IndiGrid-type assets.

Disclaimer - The suitability of each investment depends on the individual investor’s investment objectives, risk tolerance, and financial situation. Please do your own research. This blog is for education purpose .