Latest Insights

Major long-term trend in the global steel industry

Shifting from traditional, high-emission steel production to a cleaner, more sustainable method. This shift creates strong demand for graphite electrodes, making companies that produce them potentially attractive investments

Breaking It Down Point by Point

- The Shift from BF to EAF:

- Traditional steelmaking uses Blast Furnace (BF) route: Relies on coal/coke, produces high CO₂ emissions (major contributor to climate change).

- Newer method: Electric Arc Furnace (EAF): Melts scrap steel using electricity, emits 85-90% less carbon. Global trends confirm this: EAF share rising (e.g., planned capacity now ~43%, up from 33% recently), driven by regulations, green steel goals, and sustainability pressures.

- Why Graphite Electrodes Are a Proxy:

- EAF requires graphite electrodes to conduct electricity and create intense heat (~3,000°C) for melting steel.

- As more steel shifts to EAF (for "green steel"), demand for these electrodes grows structurally.

- Why These Companies Are Interesting:

- Essential but Low Cost: Electrodes are critical but only 2-3% of total EAF steel cost → Steel makers prioritize quality/reliability over price (stable demand, good pricing power).

- High Barriers to Entry: New plants need huge investment (capex) + 2-3 years to qualify with customers → Hard for new competitors.

- Consolidated Industry: Past downcycles forced weak players out → Fewer competitors, stronger survivors.

- Future Upside: Graphite also used in EV battery anodes → Optional growth avenue.

- Key Challenges:

- Raw Material (Needle Coke): Main input for high-quality electrodes; prices volatile (supply shortages, tied to oil/coal) → Directly hits manufacturer margins/profits.

- China Dumping: China mostly uses high-emission BF route → Produces cheap steel, exports aggressively ("dumping" below cost) → Floods global markets, hurts EAF producers elsewhere (lower utilization, price pressure). This indirectly affects electrode demand if EAF steel slows.

Overall Meaning

The steel world moves toward low-carbon "green" production via EAF, boosting long-term demand for graphite electrodes. Companies in this space benefit from barriers, pricing power, and consolidation—but face risks from raw material swings and cheap Chinese steel competition.

Main Companies Benefiting from the BF to EAF/Green Steel Theme

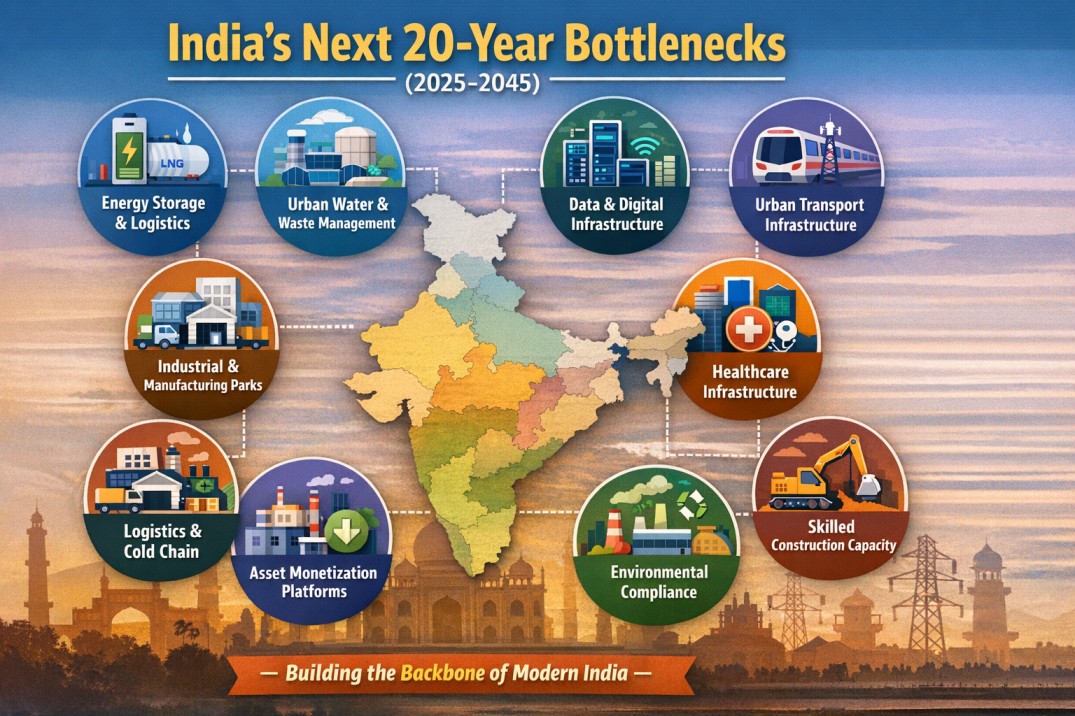

The broader beneficiaries are EAF-based or transitioning steel producers (who use more graphite electrodes and align with low-carbon steel). In India, the shift is slower than global (EAF share ~40-44% projected by 2030, vs. rising globally), but these listed companies are key players investing in EAF expansions, scrap recycling, or green initiatives:

- JSW Steel Ltd — Aggressive on EAF/scrap route; plans capacity additions and green hydrogen pilots for low-carbon steel.

- Tata Steel Ltd — Mixed routes but expanding EAF (e.g., overseas shifts); strong green steel commitments (hydrogen-based trials).

- Jindal Steel & Power Ltd (JSPL) — Significant EAF/IF capacity; DRI-EAF focus, coal gasification for lower emissions.

- ArcelorMittal Nippon Steel India (AM/NS India) — JV with global EAF expertise; expanding low-carbon production.

- Steel Authority of India Ltd (SAIL) — Mostly BF but exploring transitions; large scale.

- Godawari Power & Ispat or smaller EAF players — Niche beneficiaries.

In India, key listed players include HEG Ltd and Graphite India Ltd—often seen as proxies for this theme.

This is a classic "structural growth" investment thesis

The theme has tailwinds but risks (needle coke volatility, China dumping).