Latest Insights

Metal Sector Global Demand Growth

Metals Are Becoming Infrastructure, Not Commodities. As economies electrify, urbanize, and industrialize sustainably, metal demand becomes embedded in long term systems, not short term cycles.

1. Metals as Core Design infrastructure:

Modern economies are being rebuilt around:

- Electrification

- Energy transition

- Urban infrastructure

- Digital networks

Every one of these requires large quantities of metal, not as optional input but as core infrastructure.

Unlike earlier cycles driven by discretionary demand, today’s metal consumption is tied to:

- Power grids

- Transport systems

- Manufacturing capacity

- Data centers

These are long-cycle investments, not short-term trends.

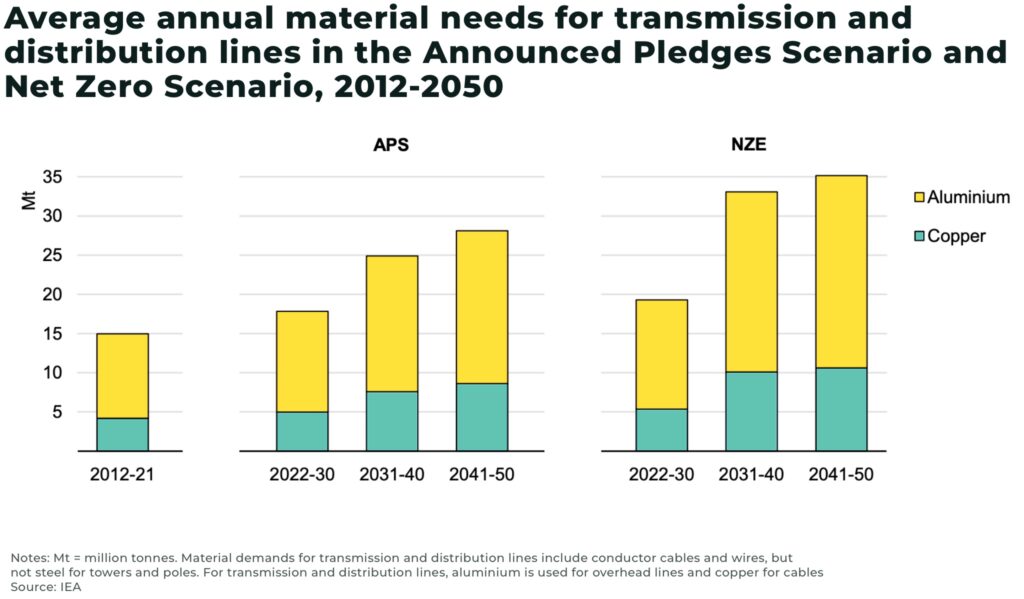

2.Electrification Is Metal-Intensive by Design

Electrification does not reduce metal demand — it multiplies it.

- Electric vehicles use significantly more copper and aluminum than ICE vehicles

- Renewable energy requires large amounts of steel, copper, zinc, and specialty metals

- Grid upgrades and transmission lines are metal-heavy assets

As electrification scales, metal intensity per unit of GDP increases, not decreases.

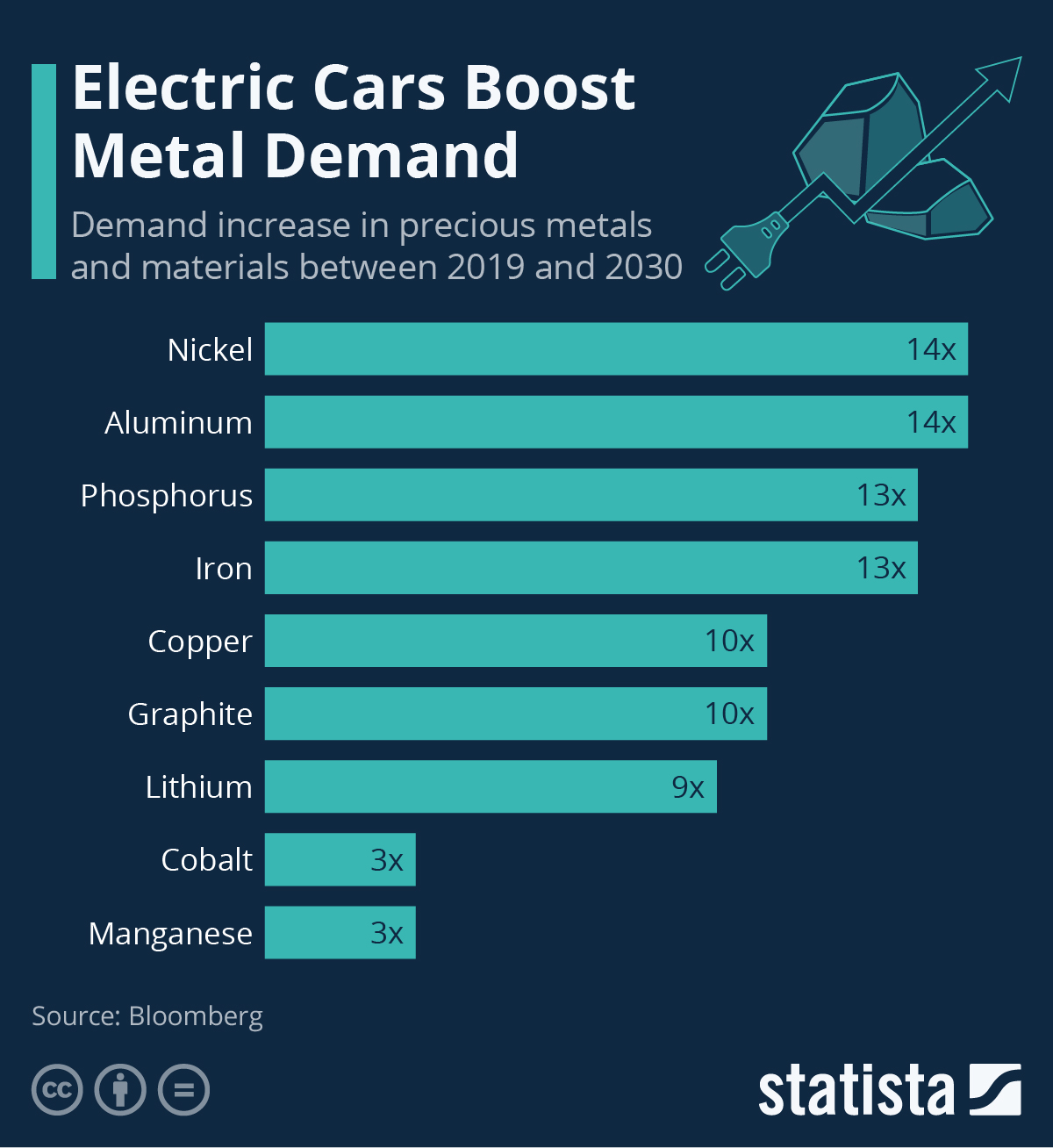

3.Energy Transition Does Not Eliminate Metals ~ It Changes Which Metals Matter

Solar, wind, and storage are often viewed as “non-metal” solutions.

In reality:

- Wind turbines require steel, copper, and rare alloys

- Solar infrastructure uses aluminum frames and copper wiring

- Battery storage relies on metals throughout the value chain

Energy transition shifts demand from fossil fuels to metal-based infrastructure.

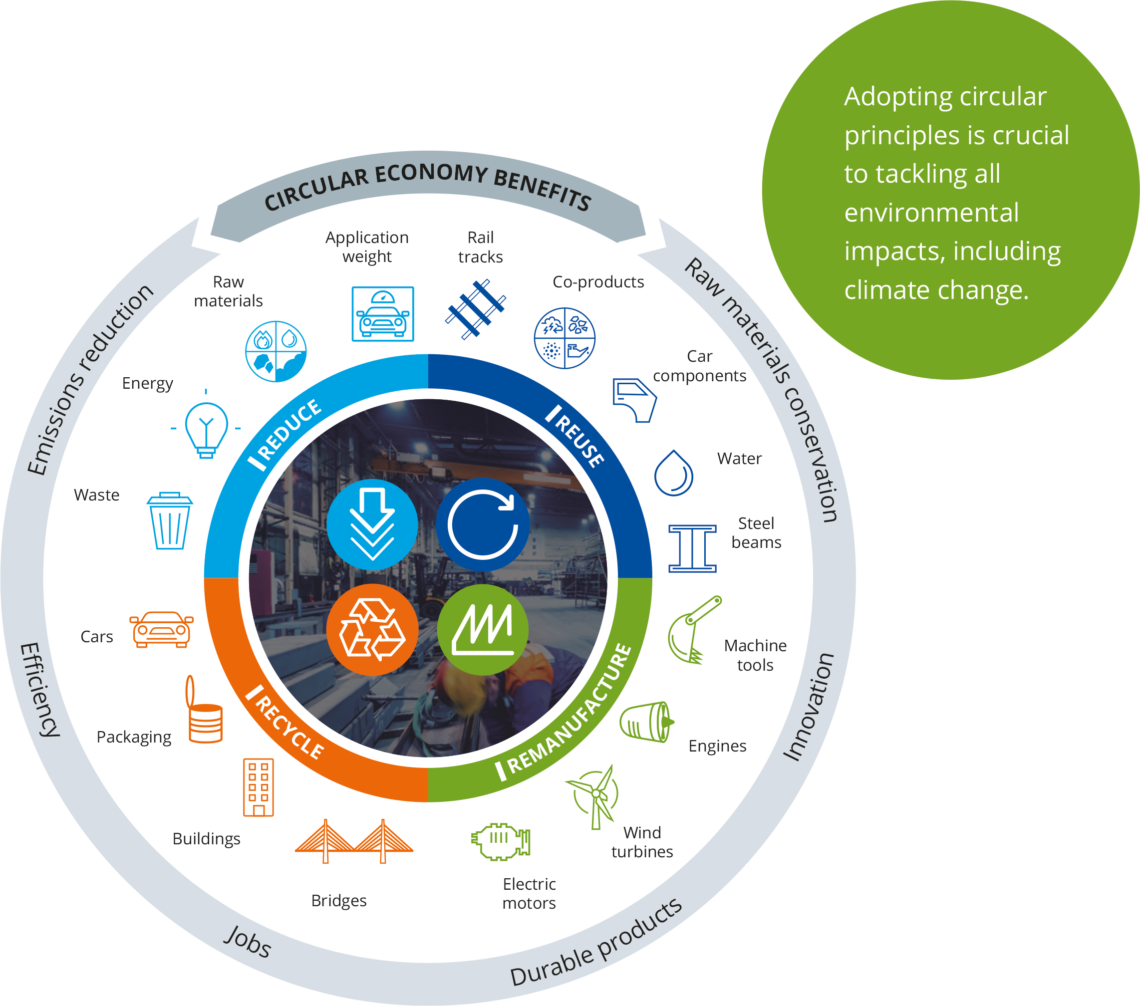

4.Recycling Becomes Structurally Important

Mining alone cannot support future demand because:

- Environmental approvals are slow

- New discoveries are limited

- Extraction costs are rising

Recycling offers:

- Lower energy usage

- Lower emissions

- Faster supply scalability

As demand grows, recycled metal becomes a strategic supply source, not just a cost-saving option.

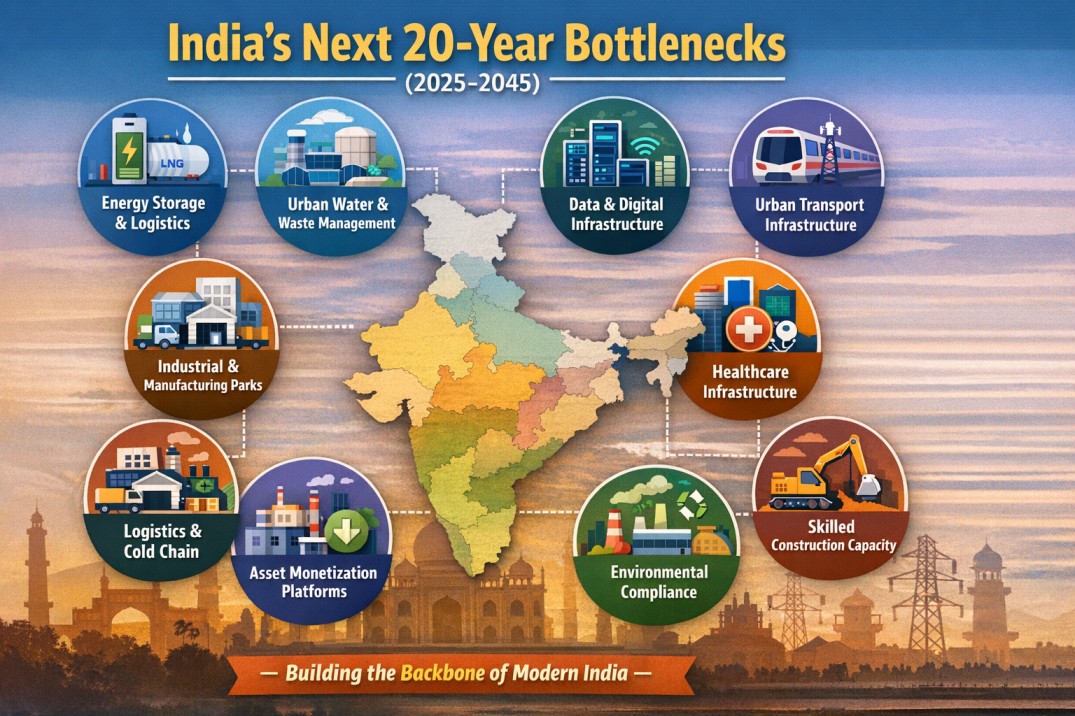

5.Urbanization Keeps Consumption Elevated

Urban development drives metal usage through:

- Residential construction

- Commercial real estate

- Transport corridors

- Water, sewage, and power systems

Even moderate urban growth creates persistent baseline demand for metals over long periods.

6.Supply Constraints Are Becoming Structural

While demand rises, supply faces challenges:

- Longer project gestation for mines

- ESG and environmental compliance

- Geopolitical restrictions on resource exports

This creates a scenario where availability, not just price, becomes the binding constraint.

7. The Metal Sector Is Moving From Cyclical to Strategic

Earlier metal cycles were driven by:

- China demand

- Inventory swings

- Short-term price movements

The next phase is driven by:

- National infrastructure priorities

- Energy security

- Supply chain resilience

- Circular economy policies

This changes how metal demand behaves during economic slowdowns it may soften, but not collapse.

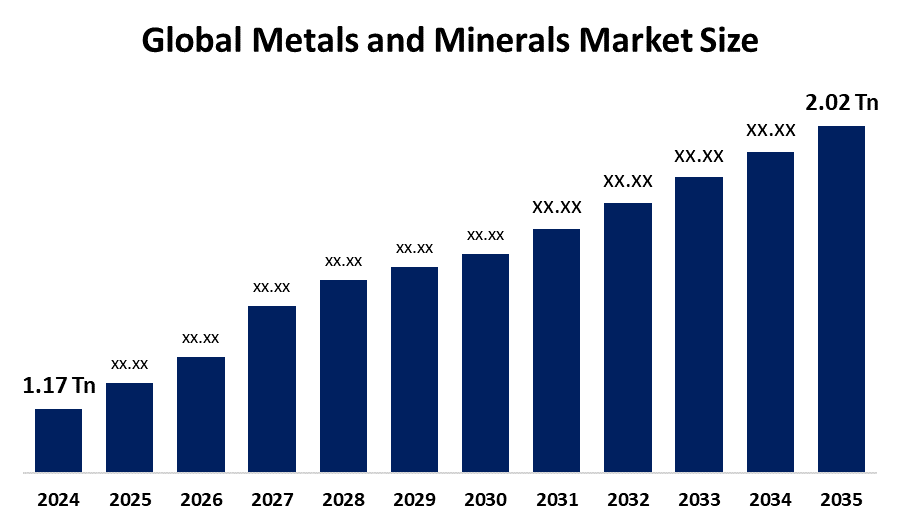

8. What This Means for the Next 10 Years

- Metal demand is likely to grow steadily, not spike and crash

- Volatility may remain, but base demand rises

- The sector shifts from speculative cycles to long-term allocation

Metals are becoming a strategic input, similar to energy or logistics.

Conclusion:

The world is not using less metal ~ it is using metal differently.

As economies electrify, urbanize, and industrialize sustainably, metal demand becomes embedded in long-term systems, not short-term cycles.

Understanding this shift is critical for anyone studying the next decade of industrial growth.