The Truth About Market Predictions No one can predict markets perfectly ~ not economists, not fund managers, not even the best investors. But there is one thing we can control: 👉 How we design our investment allocation system.

Someone says 2026 will be the best year for markets ~ massive wealth creation ahead.

Someone else says 2026 will be a disaster ~ global slowdown, market collapse, capital erosion.

So whom should we trust?

The honest answer is: no one knows.

Markets have always moved between optimism and fear. Predictions change every year, every quarter, sometimes every week. If we keep adjusting our investments based on forecasts, we end up reacting more than investing.

No one can predict markets perfectly ~ not economists, not fund managers, not even the best investors.

But there is one thing we can control:

👉 How we design our investment system.

A well-designed system doesn’t depend on the market being bullish or bearish.

It stays resilient regardless of what headlines say.

The real edge is not predicting the future.

The real edge is reducing volatility and emotional decision-making.

That’s where asset allocation plays a crucial role.

Instead of betting everything on one outcome, a balanced approach allows us to stay invested, calm, and flexible.

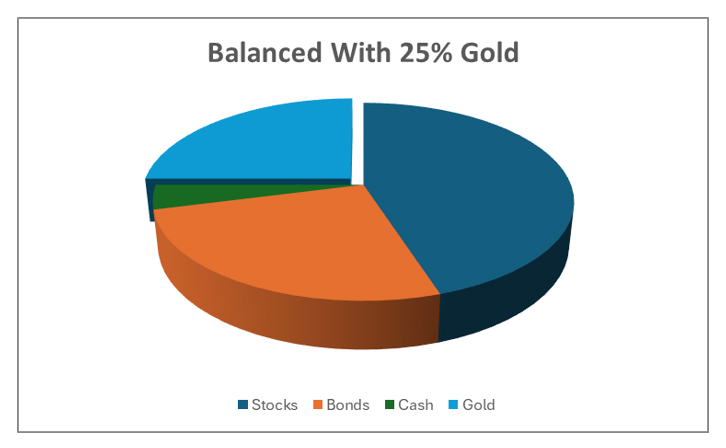

Here’s a simple framework many long-term investors follow:

This structure helps the portfolio remain less volatile, emotionally manageable, and ready for any market phase.

You don’t need to be right about the future.

You just need to be prepared.

Markets will always test patience.

Predictions will always conflict.

But a thoughtfully built system allows you to stay invested without fear, without haste, and without regret.

No prediction. Just preparation.

That’s the FinGreen way.